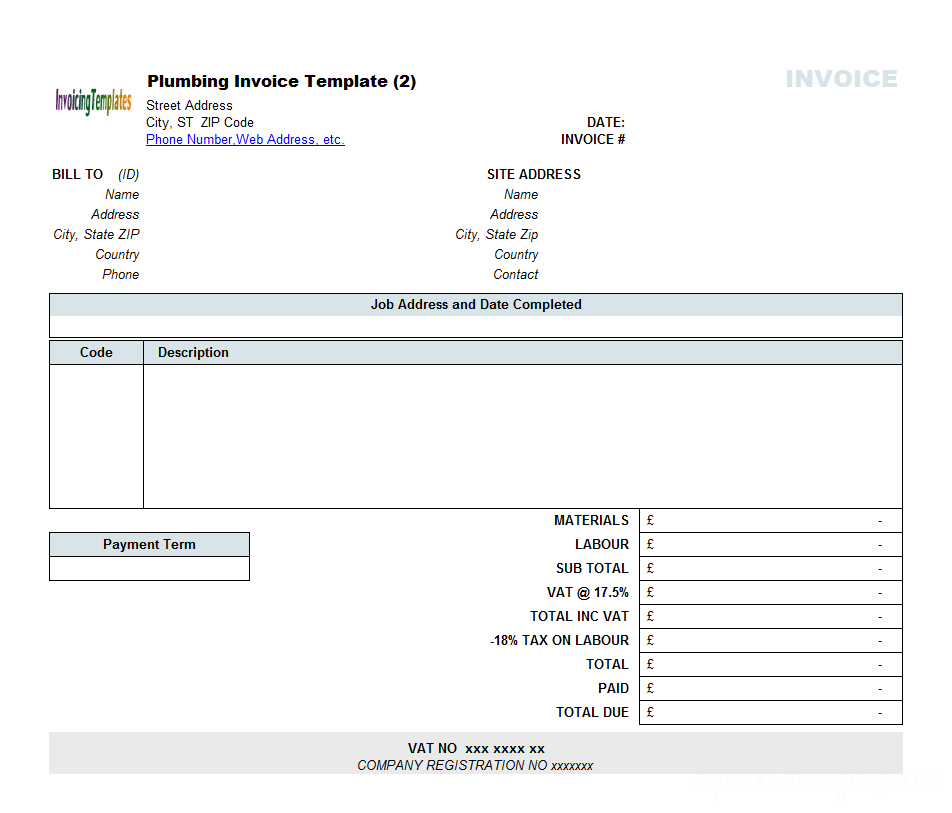

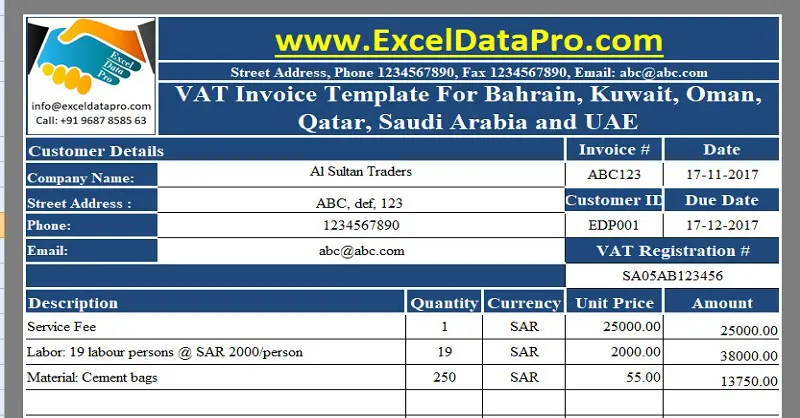

- Vat Invoice Format In Excel Download

- Vat Bill Format In Excel

- Vat Invoice Format In Excel Example

- Vat Invoice Format In Excel Spreadsheet

- Sample Invoice Format In Excel

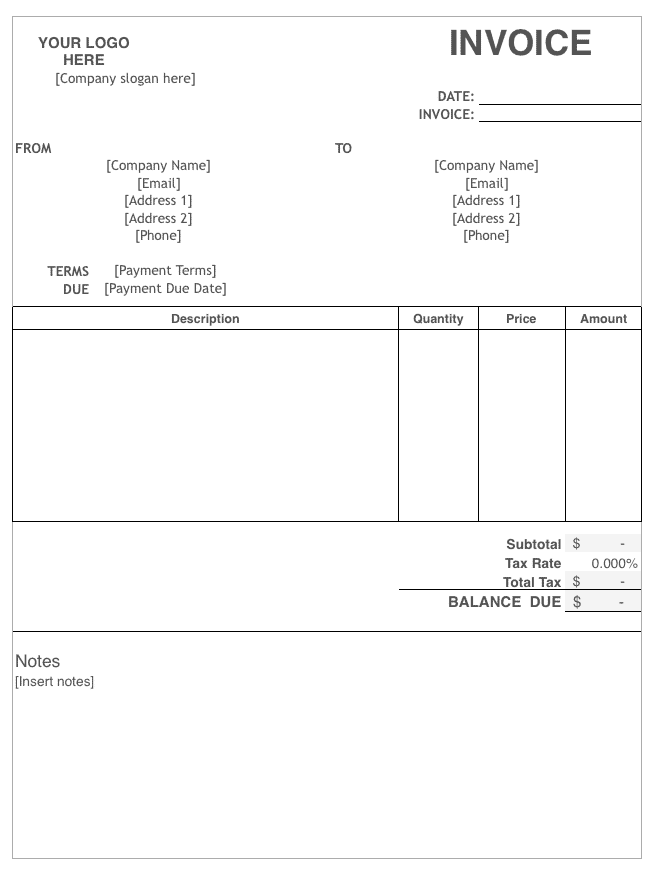

This new billing invoice template provides a very simple and professional way to bill your clients. We designed it specifically for freelancers, accountants, consultants, and other small businesses that are looking for something easy to use with a design that is easy to customize.

This template is the first in a line of new invoice and billing-related templates that will all use a similar style. This will allow you to create invoices, quotes, estimates, receipts, and account statements all with the same professional look.

Download

⤓ Excel (.xlsx)⤓ Google SheetsOther Versions

- If you use the Invoice Manager for Excel version, which is our invoicing software that turns a simple Excel-format invoice template into a complete invoicing system, note that are a number of fields added to support the requirements of this VAT invoice template.

- Invoice with VAT. Set the tax rate and this accessible template will calculate the tax automatically on the sale of your products or services.

Easy editable and printable credit note. Your Order Number (Vat Number) Description (Unit Price, Quantity, Amount Credited) Reason of Credit and Supporting Document. Available in NZ, AZ and U.K Credit Note Format Excel. Ask Excel124.Net team for Editing and custom design for your business. Multiple designs for a different type of business like. Download UAE VAT Invoice Format for Rent A Car Business In Excel-Ready-To-Use UAE VAT Invoice Format for Rent a Car Business. It is a ready-to-use invoice template with predefined formulas and VAT computations for the Car Rental business. Bilingual UAE VAT Invoice is an excel template with predefined formulas. It consists of every detail in English and Arabic language. Bilingual UAE VAT Invoice can be helpful for those businesses who have Arab customers. If in any case, the FTA demands the audits of the firm documents, it can be helpful to government departments also.

License: Private Use (not for distribution or resale)

'No installation, no macros - just a simple spreadsheet' - by Jon Wittwer

Description

This spreadsheet features a new clean and crisp design with the default color scheme set to grayscale for more ink-friendly printing. It's a piece of cake to change the color scheme, though. You can go to Page Layout > Themes > Colors, or edit the fonts and background colors to whatever you want.

The table includes a QTY (quantity) and a UNIT PRICE column so that you can enter labor charges as hours and rate and still list individual service charges. You can include a discount by entering a negative value in the UNIT PRICE column.

If you happen to live in a state that charges sales tax or gross receipts tax for services, you can use the second worksheet (the tab labeled InvoiceWithTax) that lets you include tax.

Download

⤓ Excel (.xlsx)

Description

This version of the billing invoice includes a section for defining different payment plan options. The customer can cut off this section and return it with their first payment.

License

Private Use (not for distribution or resale)

Download

⤓ Excel (.xlsx)Description

This version was customized specifically for legal professionals who charge based on an hourly rate. This template allows the descriptions to be fairly long. The descriptions wrap and the rows resize automatically.

Vat Invoice Format In Excel Download

License

Private Use (not for distribution or resale)

A Few Invoicing Tips

If this is your first invoice, start with an invoice number of 1042. You probably don't want your client to know that this is the first time you have ever billed anybody.

Mail it or send a PDF: When sending an invoice to a client, either print and mail a paper copy, or send a PDF. It is not as professional to send an invoice in an editable format like an Excel or Word document. It is extremely easy with Excel 2010 or later to create a PDF - Just go to File > Save As and choose PDF.

Terms vs. Date Due: Including the phrase 'Net 30 Days' in the TERMS field means that the invoice is due 30 days after the goods are received or the services have been performed. If you think your client may not understand that, you could change the label to DUE DATE and enter a date.

Vat Bill Format In Excel

Customer ID: If you are only billing a few clients, you may not need a Customer ID field. You could change the label to QUOTE # to refer to a previous quote, or you could just delete the label and leave the field blank.

Vat Invoice Format In Excel Example

Creating a Receipt: If you need to give a client a receipt after they pay the invoice amount, you can just change the label at the top in cell H1 from 'INVOICE' to 'RECEIPT' and add a note below the Total saying something like 'Paid in full.'

We've automated this for you. In this template, all you need to do is select 'RECEIPT' from the drop down box in cell H1 and a note will appear below the total that says 'Paid in full. Thank you!'

See Also:

Vat Invoice Format In Excel Spreadsheet

- Simple Invoicing - This article explains how you can organize your invoice files and store copies of the invoice for billing repeat customers.

Comments are closed.